Table Of Content

Mortgage pre-approval should not be confused with mortgage pre-qualification, where you tell a lender about your income and debts but don’t provide documentation to verify your claims. Getting approved for a loan with Rocket Mortgage tells you exactly how much of a loan you can qualify for. Getting preapproved is quick and easy – you can even apply online from the comfort of your home.

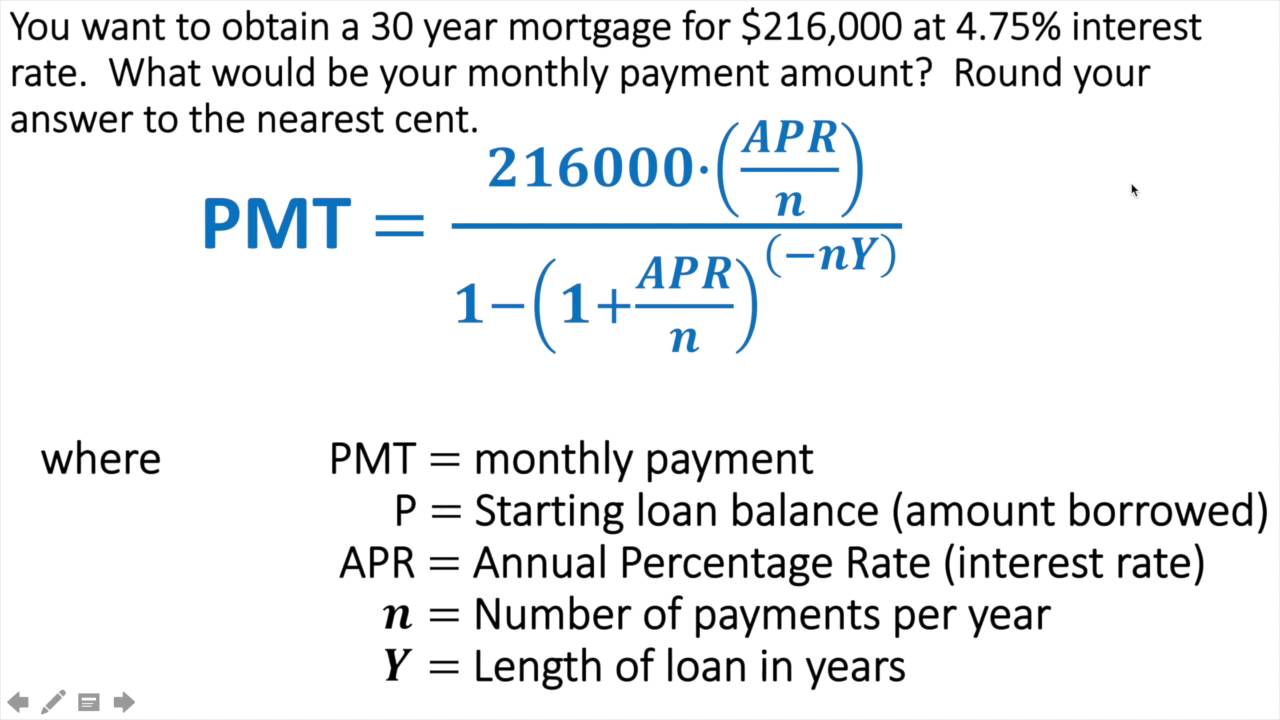

Using A Mortgage Calculator

A fixed-rate mortgage has an interest rate that doesn't change for the entire loan term. Your monthly payments will stay the same with this type of mortgage. An amortization schedule is a table that shows the amount of interest and principal you pay each month over time. In addition, the schedule will show you the total interest paid to date and the remaining principal balance on the loan. A mortgage loan is typically a self-amortizing loan, which means both principal and interest will be fully paid off when you make the last payment on the predetermined schedule — usually monthly.

Deferred Payment Loan: Paying Back a Lump Sum Due at Maturity

The monthly payment calculator above will give you an idea of the cost of a basic loan. But you may also want to use a loan calculator that is more tailored to your needs. There are several factors that determine your interest rate, including your loan type, loan amount, down payment amount and credit history. Paying a lower interest rate in those initial years could save hundreds of dollars each month that could fund other investments. In general, for a 30-year fixed loan, you will have the lowest monthly payment but the highest interest rate.

Questions To Ask A Mortgage Lender

Lenders define it as the money borrowed to pay for real estate. In essence, the lender helps the buyer pay the seller of a house, and the buyer agrees to repay the money borrowed over a period of time, usually 15 or 30 years in the U.S. A portion of the monthly payment is called the principal, which is the original amount borrowed. The other portion is the interest, which is the cost paid to the lender for using the money. There may be an escrow account involved to cover the cost of property taxes and insurance. The buyer cannot be considered the full owner of the mortgaged property until the last monthly payment is made.

Mortgages Move Up for Homeseekers: Mortgage Interest Rates Today for April 29, 2024

North Carolina Mortgage Calculator - The Motley Fool

North Carolina Mortgage Calculator.

Posted: Thu, 07 Mar 2024 08:00:00 GMT [source]

The “taxes” portion of your mortgage payment refers to your property taxes. The amount you pay in property taxes is based on a percentage of your property value, which can change from year to year. The actual amount you pay depends on several factors including the assessed value of your home and local tax rates.

But you could pay more after that period, depending on how the rate adjusts annually. If you plan to sell or refinance your house within five years, an ARM could be a good option. Technically, bonds operate differently from more conventional loans in that borrowers make a predetermined payment at maturity. The face, or par value of a bond, is the amount paid by the issuer (borrower) when the bond matures, assuming the borrower doesn't default. Use this calculator for basic calculations of common loan types such as mortgages, auto loans, student loans, or personal loans, or click the links for more detail on each. A Fixed-rate mortgage is a home loan with a fixed interest rate for the entire term of the loan.

Next steps in paying off your mortgage

In exchange, you agree to pay the lender back with interest, over a set period of time. Mortgage lenders are required to assess your ability to repay the amount you want to borrow. A lot of factors go into that assessment, and the main one is debt-to-income ratio. Aside from paying off the mortgage loan entirely, typically, there are three main strategies that can be used to repay a mortgage loan earlier.

Typically the first fixed period offers a low rate, making it beneficial if you plan to refinance or move before the first rate adjustment. Get pre-qualified by a lender to see an even more accurate estimate of your monthly mortgage payment. The average rate for a 15-year, fixed mortgage is 6.75%, which is an increase of 1 basis point from the same time last week.

VA loans are partially backed by the Department of Veterans Affairs, allowing eligible veterans to purchase homes with zero down payment (in most cases) at competitive rates. Homeowners in some developments and townhome or condominium communities pay monthly Homeowner's Association (HOA) fees to collectively pay for amenities, maintenance and some insurance. Mortgage forecasters base their projections on different data, but most housing market experts predict rates will move toward 6% by the end of 2024. Ultimately, a more affordable mortgage market will depend on how quickly the Fed begins cutting interest rates. Most economists predict that the Fed will start lowering interest rates later this summer.

Use this loan calculator to determine your monthly payment for any loan. You can also see how your loan amortizes, or how much is paid down, over the payoff period. An FHA loan is government-backed, insured by the Federal Housing Administration.

A prequalification estimates how much house you can afford, while a preapproval verifies your financial information for a loan. Jamie Johnson is a Kansas City-based freelance writer who writes about a variety of personal finance topics, including loans, building credit, and paying down debt. That means using the above example, instead of making a $60,000 down payment, you’ll owe a $9,000 down payment. You can even get a mortgage with no down payment requirements when you qualify for a USDA or a VA loan. So, if you’re purchasing a $300,000 home, that means you’ll want to make a down payment of $60,000 before closing on the loan.

No comments:

Post a Comment